How to setup a new vendor account in FIS

The Vendor Master stores information on suppliers with which the University of Toronto conducts business.

Each supplier has a vendor master record (i.e. vendor account), which is required when issuing payment through the University’s financial system. The following article provides step-by-step instructions on how to request a new vendor account.

For more information on Vendor Master Records, see Vendor Master Record Management.

Before submitting your request:

- Perform a vendor search to ensure there is no existing vendor account in FIS.

- If no existing accounts are found, obtain a supplier quote, invoice, or contract/written agreement (required for all new supplier requests or reactivations).

- Following the instructions below, complete the New Supplier Account Request form.

How to complete the New Supplier Account Request form

- Ensure the Company Name is correct, as this field will appear on the cheque. If the operating name is different from the company’s legal registered name, indicate it here as well (e.g. 1764129 Ontario Ltd, operating as XYZ Catering Inc.).

- The Business Address cannot be a PO Box number.

- If necessary, indicate the Remit To Address if different from the Business Address.

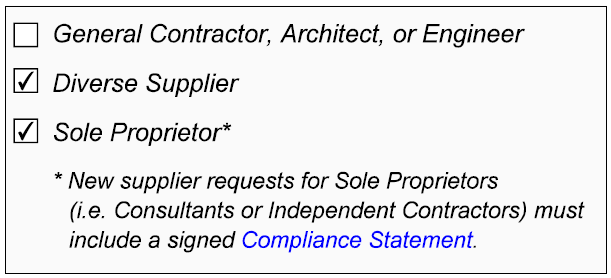

IF APPLICABLE, indicate if the supplier is a:

- General Contractor, Architect or Engineer.

- Diverse Supplier (e.g. social enterprise). For more information on Diverse Suppliers, see Social Procurement Program.

- Sole Proprietor (i.e. an unincorporated business owned by one individual); supplier account requests for sole proprietors must include a signed compliance statement

confirming that no employee/employer relationship exists between the sole proprietor and the requesting department.

confirming that no employee/employer relationship exists between the sole proprietor and the requesting department.

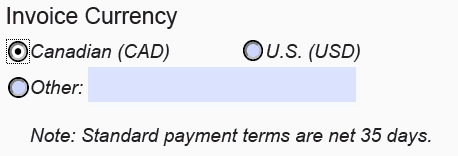

Invoice Currency: Indicate the invoice currency (CAD, USD, or other).

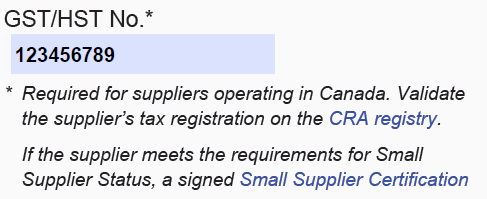

GST/HST#: If the supplier operates in Canada, a GST/HST number is required.

To expedite your request, use the CRA’s online registry to validate the supplier’s registration, and attach a screenshot to your request (watch a short tutorial).

If a Canadian-based supplier does not have a GST/HST number and meets the requirements for small supplier status (i.e. yearly earnings are less than $30,000), a signed Small Supplier Certification![]() form must accompany the request.

form must accompany the request.

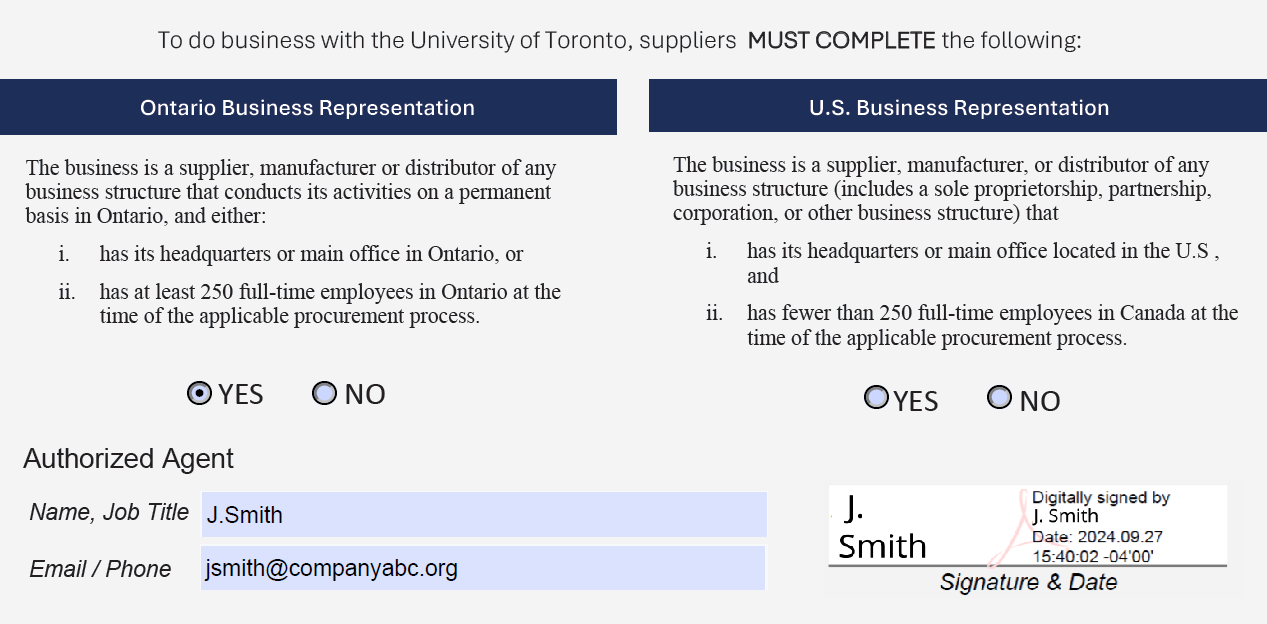

Have an authorized agent from the supplier fill out and sign the Ontario Business and U.S. Business Representation sections. For more information, see Applying Provincial Policies.

Note: Requests without this section completed will not be processed.

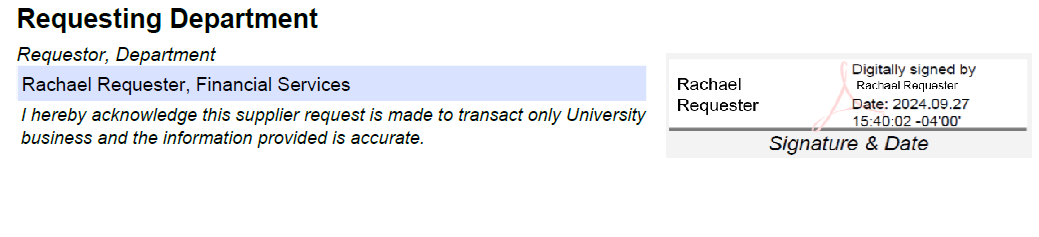

Complete the Departmental Information section, including the acknowledgement that this supplier request is for University business only.

Attach one of the following:

- Supplier quote

- Invoice

- Contract/written agreement

Send your request to purchasing.help@utoronto.ca.

Note: Standard processing time is five (5) business days.

Last Updated: June 19, 2025